On October 16, 2023, the United States Securities and Exchange Commission (“SEC”) Division of Examinations (“DOE”) released its 2024 examination priorities. The annual release of the DOE’s examination priorities is meant to inform registrants of the key risks, trends and examination topics the DOE plans to focus on in the upcoming year prioritizing areas that pose emerging risks to investors, as well as examinations of core and perennial risk areas.

As noted in the release, for the first time the DOE published the examination priorities at the beginning of the SEC’s fiscal year (which runs October 1 through September 30) instead of closer to the beginning of the calendar year which resulted in many similarities with the 2023 examination priorities published in February 2023.

Key Takeaway(s): Key Takeaway(s): Examination priorities don’t tend to change significantly year over year. However, areas of recent rulemaking, and Risk Alerts find their way into the examination priorities, e.g. marketing. Perhaps the biggest addition in 2024 is actually subtraction of ESG and electronic communications. However, recent enforcement actions in these areas likely mean they’re still a focus, just not included in the release.

2024 Examination Priorities

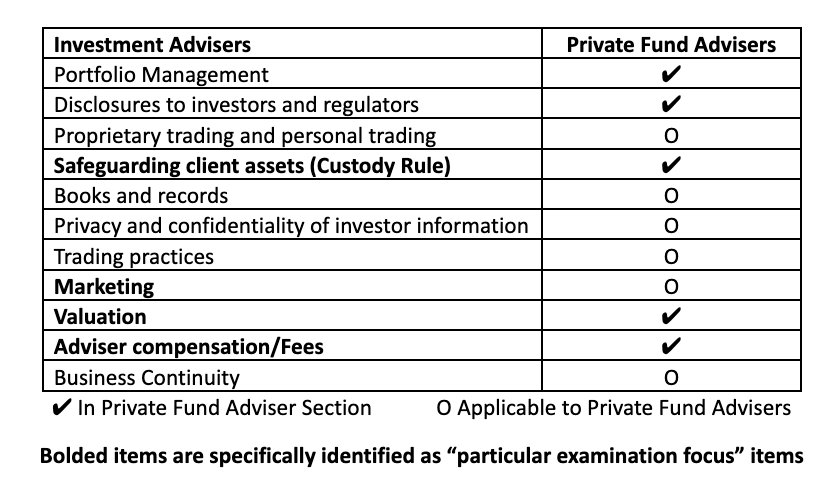

The examination priorities section on Investment Advisers is separated into two parts – Investment Advisers and Investment Advisers to Private Funds. The separation represents the continued acknowledgement from the SEC that advisers to private funds and other investment advisers have unique compliance issues. That being said, advisers to private funds would be unwise to ignore the wealth of detailed information in the broader investment adviser section of the examination priorities.

Examinations of Investment Advisers to Private Funds

Interestingly, despite the current SEC’s focus on advisers to private funds, only approximately a page of examination priorities is devoted to advisers to private funds. The DOE covered the examination priorities for private fund advisers in seven bullets (compared to three and half pages of dense content in the investment adviser section). The examination focus for private fund advisers are:

- The portfolio management risks present when there is exposure to recent market volatility and higher interest rates. This may include private funds experiencing poor performance, significant withdrawals and valuation issues and private funds with more leverage and illiquid assets.

- Adherence to contractual requirements regarding limited partnership advisory committees or similar structures (e.g., advisory boards), including adhering to any contractual notification and consent processes.

- Accurate calculation and allocation of private fund fees and expenses (both fund-level and investment-level), including valuation of illiquid assets, calculation of post commitment period management fees, adequacy of disclosures, and potential offsetting of such fees and expenses.

- Due diligence practices for consistency with policies, procedures, and disclosures, particularly with respect to private equity and venture capital fund assessments of prospective portfolio companies.

- Conflicts, controls, and disclosures regarding private funds managed side-by-side with registered investment companies and use of affiliated service providers.

- Compliance with Advisers Act requirements regarding custody, including accurate Form ADV reporting, timely completion of private fund audits by a qualified auditor and the distribution of private fund audited financial statements.

- Policies and procedures for reporting on Form PF, including upon the occurrence of certain reporting events.

On the whole, there doesn’t appear to be anything earth-shattering or unexpected about the DOE’s examination priorities as they related to private fund advisers. Of the seven identified areas of focus three – custody, fees and expenses and portfolio management – are (and have been) part of “typical examinations” for years. The inclusion of Form PF compliance should not shock anyone given the SEC’s Form PF reporting rule amendments finalized in May of 2023 and previous Risk Alerts noting easy to identify foot faults. Side-by-side management and affiliated transactions has been the focus of recent enforcement actions against private fund managers. Finally, side letters compliance is a major part of the new Private Fund Rule finalized in August. Compliance with due diligence practices seems to be the only truly new focus area.

Perhaps the most shocking development in the 2024 examination priorities is the absence of electronic communications after appearing prominently on the 2023 examination priorities and grabbing headlines throughout 2023.

Examinations of Investment Advisers

As stated above, it would be a mistake for advisers to private funds to gloss over the more general investment adviser examination priorities section. While there is some overlap between the examination priorities for both set of advisers, there are important reminders of priorities that will apply to all investment advisers e.g. compliance with the marketing rule and marketing practices.

The DOE spends a page and half focusing on adviser compliance programs, including their policies and procedures saying “[DOE] remains focused on advisers’ compliance programs, including whether their policies and procedures reflect the various aspects of the advisers’ business, compensation structure, services, client base, and operations, and address applicable current market risks.” The DOE goes on to address policies and procedures it intends to focus on from the expected policies and procedures in Rule 206(4)-7 (the “Compliance Rule”) Adopting Release.

The DOE spends the first part of the investment adviser section discussing fiduciary duty-related focus areas. Again, the examples the DOE uses aren’t directly related to private fund advisers there is significant substance for private fund advisers to consider. The four items identified by the DOE relate to:

- Investment advice provided

- Clients’ best interest and the identification and mitigation of conflicts of interest

- Economic incentives and conflicts of interest

- Disclosures made to investors

Stripping away the more retail-tailored examples and language, private fund advisers can takeaway the DOE intends to focus on the management and disclosure of conflicts of interest in the rendering of investment advice and related party transactions as seen most recently in two September 2023 enforcement actions against American Infrastructure Funds and Prime Group.

How Trillium Helps

The key to examination success is preparation. Trillium’s ongoing compliance support is designed to ensure clients are prepared when the SEC comes knocking. SEC examination support is included as part of the ongoing compliance support Trillium provides to clients. Trillium guides clients through the examination process by advising on process and document production, reviewing documents before production and providing documentation as needed from technology systems.