On August 23, 2023, the Securities and Exchange Commission (“SEC”) adopted new rules and amendments under the Investment Advisers Act of 1940 aimed at private fund advisers (the “Private Fund Rule”). The Private Fund rule touches many aspects of an advisers business including investor reporting, fund audits, offering documents, side letters, investor relations and valuation.

Key Takeaway(s): Although substantially increasing the regulation on private funds, the adopted rules and amendments are less burdensome than originally proposed. The SEC largely chose transparency, disclosure and/or consent over outright prohibitions (with a few exceptions).

Five Key Areas of Reform

Setting aside the annual review documentation requirement which you can read more about HERE and applies to all SEC-registered investment advisers, the Private Fund Rule has five key provisions. Click on each part of the rule for a detailed analysis.

- Quarterly Statement Rule

- Annual Audit Rule

- Adviser-led Secondaries Rule

- Restricted Activities Rule

- Preferential Treatment Rule

In the SEC’s Private Fund Adviser Reforms: Final Rules Fact Sheet they highlight two additional complementary points.

- Books and Records Rule Amendments – The SEC included amendments to the books and records rule under the Advisers Act to facilitate its ability to assess compliance with the Private Fund Rule.

- Legacy Status – The SEC provided legacy status for the prohibitions aspect of the Preferential Treatment Rule and the aspects of the Restricted Activities Rule that require consent. The legacy status applies to governing agreements that were entered into prior to the compliance date if the applicable rule would require the parties to amend the agreements.

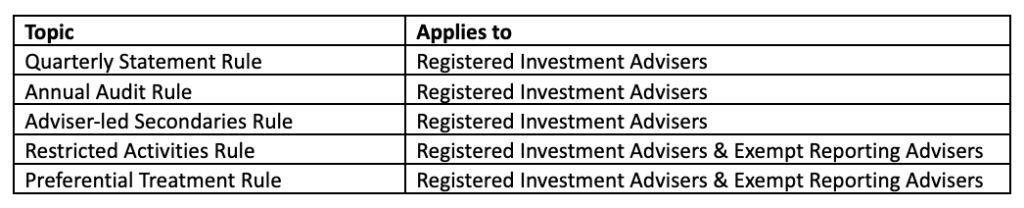

Application

The Private Fund Rule’s provisions apply to different types of private fund advisers depending on the provision.

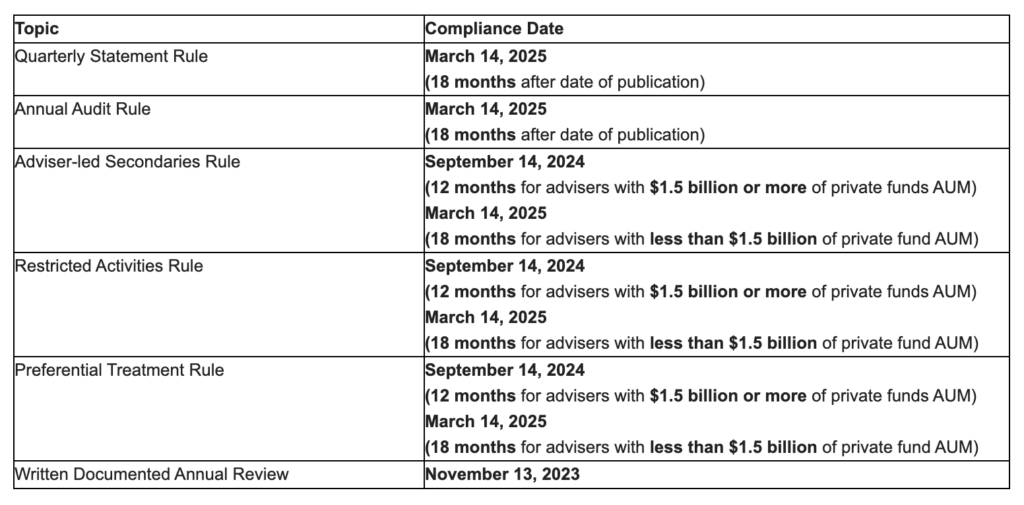

Compliance Dates

There are different compliance dates for the Private Fund Rule’s provisions depending on the provision and the size of the private fund adviser. Each compliance date is in reference to the date of publication in the Federal Register.

If you are looking for assistance meeting the compliance dates, please contact Trillium today.